According to the prevailing norms underneath the Income Tax Act, 1961 $ $You may be suitable for Money Tax benefits According to the relevant earnings tax laws in India, that are subject matter to change from time to time.

This merchandise is specifically designed for your life ambitions which include larger education for your children, their relationship, wealth creation for residence, foreign vacation or providing for outdated age, and so on. Key Capabilities :

To put it differently, Significant Disease profit is just not payable if the daily life assured dies inside fourteen days in the day of diagnosis on the covered essential health issues. Waiting Period for Significant health issues profit

This product is meant to meet your goals and problems like a father or mother - preserving for your son or daughter's training and securing their bright potential against the uncertainties of lifestyle. The nominee should be a baby, whose curiosity the policyholder wants to protect. This approach delivers insurance coverage address towards the proposer who's the lifetime confident and the policyholder, for Demise and accidental full lasting disability (ATPD) throughout the expression with the coverage. Clever Benefits

SBI Existence- Sensible Champ Coverage Program presents guaranteed smart Advantages that can help include your child’s instructional needs. These Rewards are payable in four equivalent annual instalments once the little one attains eighteen many years of age till the kid turns 21 many years of age, i.e. at the end of Each and every of very last four coverage years. 1st installment, 2nd installment, 3rd installment and final installment of Wise Positive aspects are payable at the conclusion of the coverage 12 months where the kid completes 18, 19, 20 and 21 many years of age respectively. Each and every installment of Clever Positive aspects will include 25% of The essential sum assured and twenty five% from the vested simple reversionary bonuses, if declared. Terminal bonus, if declared, are going to be compensated together with the previous installment of Wise Added benefits.

The investments are managed in your behalf by SBI Daily life by means of Benefit Program. It reallocates the assets among credit card debt, equity and cash market devices with regards to the time remaining to maturity with the policy to handle the hazards. Pay back rates conveniently

1) On Dying on the daily life confident before the commencement in the payout time period, Sum confident on Loss of life is payable as lump sum into the nominee or lawful heir on the life assured plus the policy terminates.

The nominee or authorized heir shall have an option to receive the discounted price of the long run Certain Money, in the shape of a lumpsum, at any time through the Payout Interval, discounted at eight.25% for each annum. The place sum certain on death is better of the following:

e) Partial withdrawals are allowed only towards the stipulated factors:

You've an choice to choose the mode of payment of the death benefit or Terminal sickness benefit - lumpsum, regular monthly instalments or a mix of the two. Greater 50 % profit

"The Device Joined Insurance policy items do not give any liquidity in the course of the initial 5 years with the contract. The policyholders will not be ready to surrender or withdraw the monies invested in Unit Connected Coverage Items wholly or partially till the end of fifth 12 months"

So, if a certain investment technique will not be Operating for yourself, it is possible to re-evaluate and select a unique one to reach your goals. Selection of 9 fund options less than Sensible Option Strategy

* A non-smoker wholesome male of twenty-two several years, Investment of ₹2500 monthly beneath Progress Strategy possibility, 20 years plan term enjoys maturity advantage of ₹.seven.sixty eight lacs (@assumed fee of return four%)^^ & ₹. 11.85 lac (@assumed charge of return 8%)^^. Minimum amount month to month top quality sum allowed to commence your insurance policies system. Expansion & Well balanced are dependant on overall publicity to equity, debt and money market devices throughout plan term. Tax Advantages are According to Profits Tax Rules & are topic to vary once in a while. Remember click over here now to consult your Tax advisor for information. Fund Benefit figures are for illustrative functions & for healthful everyday living. Please Take note that the above pointed out assumed premiums of returns @four% and @eight% p. a., are only illustrative eventualities, soon after looking at all applicable fees. These are not assured and they're not larger or lessen limits of returns. Unit Linked Daily life Insurance items are topic to market place risks. The varied cash offered under this deal will be the names in the money and don't in almost any way reveal the caliber of these ideas as well as their potential potential customers orreturns. To learn more, request on your policy specific profit illustration. Device Linked Lifestyle Insurance policies merchandise are distinct from the traditional solutions and therefore are subject to marketplace risks.The high quality paid in Device Linked Insurance plan policies are issue to investment hazards connected with cash markets and also the NAVs of the units may perhaps go up or down depending on the performance of fund and factors influencing the money sector as well as the insured is accountable for his/her choices.

Pay back premiums for Constrained time period or as Single Payment, as per your ease and revel in Rewards throughout the policy phrase. Two protection solutions :

(one) Increased education and learning of youngsters which include legally adopted little one. (two) Relationship of youngsters together with legally adopted kid. (three) Purchase or construction of a residential home or flat while in the lifetime confident's have name or in joint title with their lawfully wedded wife or husband. Even so, If your life confident by now owns a household dwelling or flat (other than ancestral home), no withdrawal shall be permitted. (4) For therapy of critical ailments of self or wife or husband or dependent kids, like legally adopted little one. (five) Health care and incidental expenditures arising from disability or incapacitation experienced from the daily life confident (6) Expenses incurred with the life certain Related Site for ability improvement/reskilling or another self-growth activities.

Utilization of 3rd party firm logos doesn't suggest any affiliation with investigate this site or endorsement by These companies. Beagle Spend, LLC reserves the correct to limit or revoke any and all provides Anytime.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Danica McKellar Then & Now!

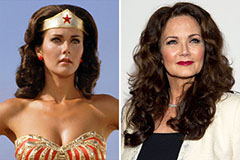

Danica McKellar Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!